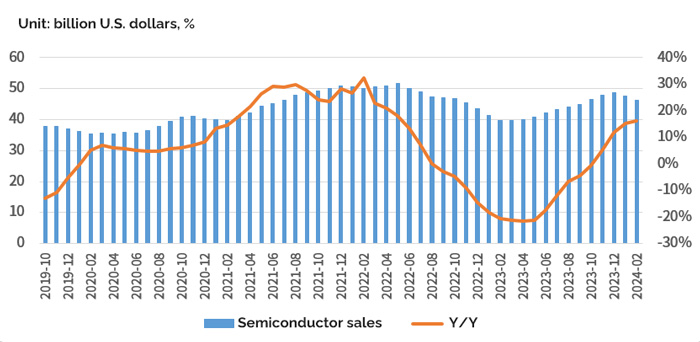

According to the latest data from SIA, global semiconductor industry sales in February 2024 were US$46.17 billion, a year-on-year increase of 16.3% and a month-on-month decrease of 3.1%. The year-on-year market growth has continued the strong trend since the middle of last year. SIA expects it will continue to grow, and the global semiconductor industry has a clear rebound signal.

Source from EET

Global integrated circuit output in February was approximately 108.9 billion units, a year-on-year increase of 10.2%. However, in 2024Q1, global electronic components delivery times continue to decline. Affected by quarterly demand, inventory will continue to be adjusted, and some categories will fluctuate significantly.

Electronic Components Manufacturers Overview

In 2024Q1, the overall supplier delivery time and price were improving, but the spot trading market continued to be sluggish. The delivery times of automotive-grade products such as PMIC, MOSFET, IGBT, and MCU continue to improve, and the demand and prices have slowed down. The price fluctuations of FPGA, radio frequency, and consumer products have decreased, and the demand has been stable. Analog chip prices have stabilized, but demand has not improved. The volume and price of storage and automotive-grade passive components have both increased.

Delivery Time & Price

The delivery time trend of most manufacturers is stable and going to be shortening. For example, the delivery time of most electronic components of ADI, Microchip, and ST has been significantly shortened, and the prices have tended to be stable.

Manufacturers such as TI, ST, ADI, NXP, Infineon, and Microchip have experienced significant inventory fluctuations and relatively weak demand. The market for AI-related chips is relatively hot but few transactions, such as Broadcom. Demand for consumer chips such as Qualcomm and NXP continues to rebound.

For instance, the inventory of TI LM358DR, used in industrial control, automotive, and other fields, has dropped and many orders were canceled. The demand for STM32F103, STM32F405, and STM32F407 series MCUs, used in consumer electronics and automotive fields, is relatively stable. ADI LTC6078HMS8#PBF and other amplifiers used in communications and automotive fields have seen a decline in demand, and prices have also been adjusted. Microchip DSPIC30F2010-301/SP is used in industrial and automotive fields, its delivery times have shortened, but suffered in sluggish demand.

Order And Inventory Situation

Judging from the order and inventory situation in 2024Q1, the order situation of most leading manufacturers is in a stable state. The ones with lower stocks are Renesas and Murata.

STMicroelectronics Q1 net revenue was US$3.465 billion, down 18.4% year-on-year and 19.1% month-on-month. Gross profit was US$1.444 billion, down 31.6% year-on-year and 26% month-on-month. The gross profit margin was 41.7%. Net profit was US$513 million, down 50.9% year-on-year. , a month-on-month decrease of 52.4%. As the first quarter financial report was not as good as market expectations, ST lowered its full-year revenue outlook for 2024. It is mainly due to the decline in demand for automotive chips and the continued shrinkage of orders for consumer electronics products such as NB and mobile phones. Demand for automotive chips is not expected to pick up until the end of the year.

Source from Internet

Recently, AI-related demand has been relatively strong, and consumer orders have increased significantly, while automobile demand and inventory are subject to certain fluctuations. Inventory of TI's automotive chip is rising, and there are many canceled orders in Q1. Samsung's NAND plans to increase prices by 15-20%, and chip revenue this year is expected to return to the level of 2022. ADI's analog chip has a huge inventory, and Q1 automotive department revenue may have a year-on-year decrease of 23%.

Semiconductor Capacity & Market Demand

In terms of foundry, the capacity utilization rate in 2024Q1 is still at a low level. The capacity utilization rate of most mature processes is under pressure, and the center of capital expenditure is advanced processes.

TSMC's Q1 capacity utilization rate is 85%, and CoWoS production capacity has doubled and is still in short supply. Samsung's capacity utilization rate is 70%-80%, HPC orders are increasing rapidly, and OEM profits are sluggish.

In terms of the terminal application market, in 2024Q1, consumer electronics demand continued to recover, and AI became a new growth point in the PC market. New energy vehicles engage in price wars and market competition intensifies. The industrial control market demand continues to be sluggish and is still in the inventory reduction stage. The market supply in the photovoltaic industry exceeds demand, inventory depletion continues, and overseas orders from some manufacturers have recovered. Competition pressure in the energy storage industry has increased, inventory problems still exist, and terminal demand remains optimistic. Demand from AI chip and server integration manufacturers continues to rise, and sales of high-value-added products such as HBM have increased significantly. Customer demand on the communications side is sluggish.

Conclusion

The global semiconductor industry has experienced a year-long trough. Due to a certain adjustment cycle in terminal demand, supply chain fluctuations continue.

According to an analysis by industry insiders, due to the cyclical characteristics of the semiconductor industry, coupled with changes in terminal demand and trade environment, supply chain fluctuations will continue in the short term, and the recent weakness of the market has recovered trend.

Related News

TSMC releases A16 new chip manufacturing technology for the first time

Combining leading nanosheet transistors and innovative backside power rails, mass production is expected in 2026.

- Micron takes the lead in mass production of 232-layer QLC NAND products for clients and data centers

This product is now in mass production and is being shipped in some Crucial SSDs. At the same time, 2500NVMeTM SSD has also been mass-produced for enterprise storage customers and is sampling to PC OEM manufacturers. - NVIDIA ships the world’s first DGX H200 to OpenAI

- ROHM and STMicroelectronics announce expansion of existing multi-year, long-term 150mm silicon carbide wafer supply agreement with SiCrystal

Involves the supply of larger quantities of silicon carbide wafers produced in Nuremberg, Germany, with an expected minimum value of US$230 million.