Since 2022 Q2, the average inventory of industrial control chips has shown an upward trend, and the global industrial control industry has entered a stage of inventory adjustment. Taking Texas Instruments as an example, its lead time increased from 134 days in 2022 Q4 to 179 days in 2023 Q1, while STMicroelectronics increased from 97 days in 2022 Q4 to 115 days in 2023 Q1. In addition, the lead time of Infineon, onsemi, NXP, Renesas, Vishay, and Diodes are also increased, with an average of 127 days.

The Trend of MCU, PMIC, and FPGA

The industrial control is one of the most widely used fields of Microcontroller. MCU is the core component of industrial automation, such as stepping motors, industrial motors, robotic arms, etc. Overall, the delivery period of MCU is showing a downward trend. The average lead time and price of industrial control/general-purpose MCU chips will drop significantly in 2023 Q2. According to data from leading industrial control MCU manufacturers such as TI, ST, Infineon, Microchip, NXP, and Renesas, the lead times for 8-bit MCUs and 32-bit MCUs are shortening, and prices are gradually returning to the normal level. Except, of course, for automotive series MCUs.

Source: Internet

Industrial control PMICs affected by weak terminal demand are also gradually returning to normal price levels. When it comes to PMIC, I have to mention Texas Instruments. TI's PMIC was one of the most sought-after chips in the semiconductor market in the past two years. At present, the delivery time of most industrial-grade series PMICs has been significantly shortened, and the prices have also dropped from the previous high to normal levels, although the current prices are still somewhat inflated. For example, the PMIC represented by TPS53513RVER has dropped from 1,000 yuan to about 10 yuan.

The lead time of ADI amplifiers, interface ICs, and switching regulators is stabilized, though the prices are increased. Also rising in price is Renesas. STM, onsemi, and Microchip are mostly stable.

As one of the most widely used FPGAs in the field of industrial control, its delivery time has improved, and the shortest has been shortened to about 20 weeks, but the price is still at a high level with little fluctuation. Among them, the delivery date and price of ADM (Xilinx) are on the rise. Although the delivery date of the Spartan 6 series in the first half of the year has improved, the price increase is still as high as 8%-25%.

Conclusion

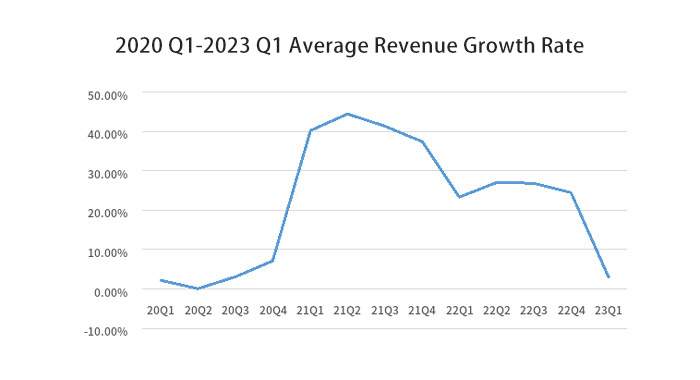

Judging from the revenue data of industrial control leading manufacturers in the past two years, since the peak period of 2020 Q4-2022 Q1, the industry has gradually declined and will enter a trough in the first half of 2023. In the main application market of industrial control, the demand for traditional industries such as petrochemical, logistics, and metal processing is slowing down, while the demand for consumer electronics is difficult to return to the peak, and the automobile industry is in a stage of transformation. With the release of new production capacity in the industrial control chip, the demand and price of industrial control products represented by MCU and analog chips may continue to decline.

Source: Wind、EET

But in the long run, with the rise of new energy sources, such as lithium batteries, photovoltaics, energy storage, etc., and the new demand brought by electric vehicles, driven by the recovery of the macroeconomic environment, perhaps the industrial chip industry is expected to recover during Q4.