On April 8, Infineon Technologies announced the acquisition of Marvell Technology's automotive Ethernet business for $2.5 billion in cash, with funds coming from the company's existing liquidity and new financing. The transaction is expected to close within calendar year 2025, and is subject to customary closing conditions and regulatory approval.

Through this transaction, Infineon will further improve its leading automotive microcontroller product portfolio. After combining with Marvell's automotive Ethernet business, Infineon will enhance its system capabilities in software-defined vehicles. It is expected to bring in revenue of US$225 million to US$250 million in 2025, with a gross profit margin of nearly 60%. Besides, Infineon will gain more growth opportunities in IoT applications, such as humanoid robots.

Source from Internet

Ethernet is a key technology for low-latency, high-bandwidth communications, which is essential for software-defined vehicles. In addition, it also has great potential in related application areas such as humanoid robots. Therefore, this investment will further strengthen Infineon's layout in the US market, including extensive R&D activities.

“The acquisition is a great strategic fit for Infineon as the global number one provider of semiconductor solutions to the automotive industry,” says Jochen Hanebeck, CEO of Infineon. “We will leverage this highly complementary Ethernet technology by combining it with our existing, broad product portfolio to provide our customers with even more comprehensive, leading solutions for software-defined vehicles. The transaction will support our profitable growth strategy going forward, including new opportunities in the field of physical AI such as humanoid robots.”

Marvell's automotive Ethernet business has more than 50 automaker customers, including 8 of the top 10 automakers. With its strong customer base, Marvell expects to reach approximately $4 billion in design-win projects by 2030 and pave the way for future revenue growth with an innovation roadmap. Further cost synergies are expected to be generated by integrating R&D capabilities and leveraging Infineon's production scale.

Source from Internet

Marvell's automotive Ethernet business has hundreds of highly qualified and professional employees and offices in the United States, Germany, and Asia. After the transaction, it will be integrated into Infineon's Automotive Electronics Division.

Matt Murphy, Chairman and CEO of Marvell Technology, said, Given the attractive valuation of this transaction, we believe it will provide a strong financial return for our shareholders. With Infineon's optimized automotive application platform, we believe that the Automotive Ethernet business is well-positioned for continued growth and success.

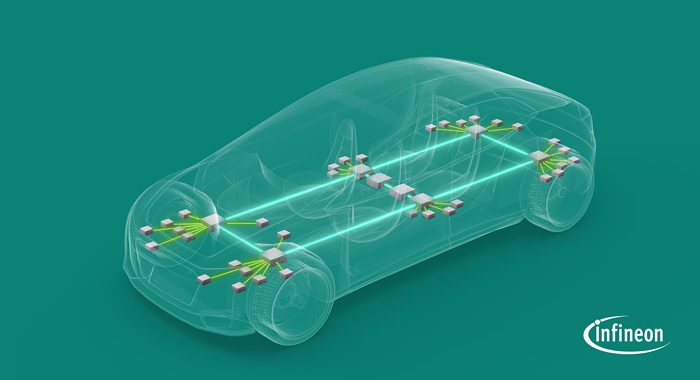

Ethernet connectivity solutions are critical to software-defined cars and are the foundation of an efficient electronic and electrical architecture consisting of central computing, and regional and terminal devices. Advanced features such as advanced driver assistance systems, autonomous driving, and wireless software updates require the ability to securely process, transmit, and store massive amounts of data. Marvell's leading Brightlane™ automotive Ethernet product portfolio includes PHY transceivers, switches, and bridge products, supporting network data transmission rates from the current 100 Mbps (megabits per second) to the market-leading 10 Gbps (gigabits per second), and also supports the information security and functional safety required for today's and future in-vehicle networks.

By combining Marvell's automotive Ethernet business with Infineon's AURIX™ microcontroller family, Infineon will be able to offer a more comprehensive portfolio of communication solutions and real-time control. This acquisition will further strengthen Infineon's leading position in the microcontroller field.

Regarding this transaction, C.J. Muse, senior managing director of financial services firm Cantor Fitzgerald, said, Marvell Technology has clearly made AI its core strategy and focused on customized chips and network businesses. In this context, the automotive Ethernet business is unlikely to be their focus, so they will be willing to sell the business at the right price. Acquiring it at a price of 10 times sales is a very attractive price for Marvell.

Marvell Technology in March forecast that its first-quarter revenue would be in line with Wall Street's more conservative expectations.

Analysts at JPMorgan Chase said the conservative forecast was mainly due to "weak demand for enterprise data center products," specifically the slowdown in the market for Ethernet cables and Fibre Channel used to transmit data between servers.

The chip industry is also expected to be hit by U.S. President Trump's tariffs on several countries, including China.

However, Infineon slightly raised its full-year revenue forecast in February due to a smaller-than-expected revenue decline in the first quarter of this fiscal year and expected exchange rate effects.