The semiconductor industry enters a transformative phase in H2 2025, marked by NAND Flash price recovery driven by production cuts and AI demand, Infineon €1B EU-backed Dresden fab expansion, and Analog Devices emergence from the downturn. Key innovations include STMicroelectronics-AWS silicon photonics for AI clusters, Apple 5G baseband chip debut, and Renesas ultra-low-power MCUs. CICC highlights the surging demand for high-end passive components in AI and EVs.

1. NAND Flash Market Sees Price Rebound in H2 Driven by Production Cuts and AI Demand

According to TrendForce, the NAND Flash market faced persistent oversupply and price declines in Q1 2025, pushing manufacturers into losses. However, the supply-demand balance is expected to improve significantly in the second half of the year (H2), driven by production cuts from major manufacturers (Samsung, SK Hynix), smartphone inventory adjustments, and surging demand from AI applications and the DeepSeek effect. This shift is projected to alleviate oversupply and trigger a price recovery. Notably, SanDisk's High Bandwidth Flash (HBF) technology aims to complement High Bandwidth Memory (HBM), offering 8-16 times the capacity at lower costs, thereby addressing AI-driven storage demands.

2. Renesas Launches RA4L1 MCU Line with Ultra-Low Power and Advanced Security

Renesas introduced the RA4L1 microcontroller (MCU) family, featuring 14 models with TrustZone security, segment LCD support, and ultra-low power consumption (168µA/MHz at 80MHz). Based on the 80MHz Arm Cortex-M33 processor supporting TrustZone, the new MCU has reached the industry's advanced level in performance, functions, and energy saving, providing designers in fields such as water meters, smart locks, and IoT sensor applications with more excellent solution options.

Source from Renesas: RA4L1 ultra-low-power MCUs

The RA4L1 controller uses proprietary low-power technology, with a power consumption of 168µA/MHz in 80MHz mode; while retaining all SRAM, the standby current is only 1.70µA. In addition, the new products also use ultra-small packages, including 3.64 x 4.28 mm wafer-level chip packages (WLCSP), which can meet the needs of products such as portable printers, digital cameras, and smart tags.

The RA4L1 controller is now available together with the FSP software. In addition, Renesas also provides RA4L1 evaluation boards and RA4L1 capacitive touch evaluation systems.

3. Analog Devices (ADI) Emerges from Industry Downturn on Strong Financial Signals

CEO Vincent Roche stated that Analog Devices has passed the industry's trough, citing a 15% year-over-year reduction in channel inventory and recovering order volumes. Despite market volatility, the company's Q1 2025 revenue of $2.42 billion exceeded expectations, with resilient performance in industrial and automotive sectors. Advanced sensor technologies and an expanding presence in China's electric vehicle and AI markets further support ADI's recovery.

4. STMicroelectronics and AWS Collaborate on Next-Generation Silicon Photonics for Data Centers

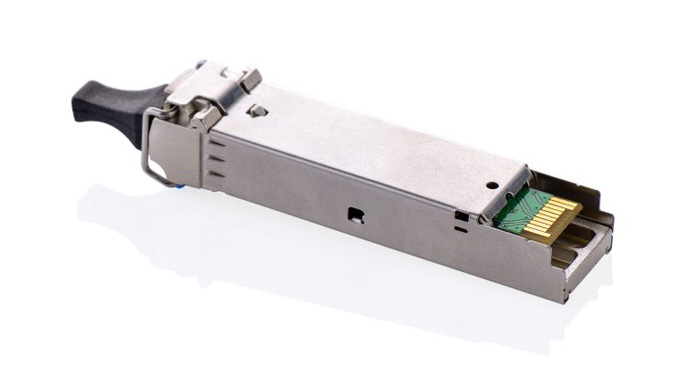

STMicroelectronics unveiled its PIC100 silicon photonics technology, co-developed with Amazon Web Services (AWS), to enhance high-speed optical interconnects in AI clusters and data centers. The 300mm wafer-based technology integrates multiple components on a single chip, enabling 800Gb/s and 1.6Tb/s pluggable modules slated for mass production in H2 2025.

Source from STMicroelectronics: The PIC100 makes pluggable modules more efficient

ST also trailer its next-generation BiCMOS technology B55X, which is based on silicon germanium and a 55nm node, can achieve ultra-high-speed, low-power optical connections, and can increase the efficiency of solutions using PIC100 by another 15%. The company is also developing TSV-based compact modulators for GPU-to-chipset interconnects.

5. Infineon Secures EU Funding for Dresden Smart Power Fab Expansion

On February 20, Infineon announced EU approval for funding under the European Chips Act to support the construction of its Smart Power Fab in Dresden. The €1 billion project has also received backing from the EU's IPCEI ME/CT innovation program. Construction began in March 2023 and remains on track for a 2026 operational launch, creating over 1,000 high-skilled jobs. Additionally, Infineon plans to invest €2.3 billion in R&D across Germany and Austria between 2022 and 2027, focusing on power electronics, analog/mixed-signal technologies, and sensors.

6. Apple Debuts First-Generation 5G Baseband Chip C1 in iPhone 16e

Apple launched its in-house 5G baseband chip, the C1, with the iPhone 16e. Fabricated using TSMC's 4nm process for the core and 7nm for the RF transceiver, the chip optimizes power efficiency, enabling up to 26 hours of video playback. However, the lack of millimeter-wave (mmWave) support limits peak speeds in mmWave-enabled regions. A mmWave-compatible successor is planned for 2026, with future integration of the baseband into Apple's main processor.

7. CICC Highlights AI-Driven Demand Surge for High-End Passive Components

A China Securities Journal report notes surging demand for passive components driven by AI, EVs, and consumer electronics recovery. AI servers, PCs, and smartphones are projected to boost MLCC demand by 100%, 40-60%, and 20% respectively, alongside higher requirements for power handling, frequency, and reliability. The global AI-related MLCC and chip inductor market is forecast to grow at over 30% CAGR through 2030, emphasizing the need for integrated supply chains.