For many years, investment mergers and acquisitions have been a hot topic in the semiconductor industry, 2021 is no exception. In the past year, the global semiconductor industry has effected by the chip shortage, price increase, acquisitions, and expansion, etc., and gradually formed a new market structure and situation. Let’s look back at the investment mergers and acquisitions in 2021.

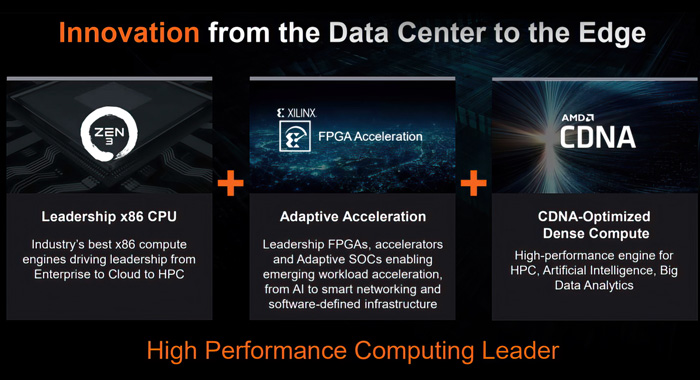

AMD acquired Xilinx

In Oct. 2020, AMD acquire a Xilinx for US$35 billion (in the form of stock), the Shareholders voted for approval in April 2021, and the transaction is expected to be completed in the first quarter of 2022.

Intel and NVIDIA are the mainly competitors of AMD, among Intel occupies most of the market share. However, in recent years, under the pursuit of AMD, the market share of Intel has gradually declined. AMD may integrate Xilinx FPGA IP in CPUs and GPUs. Xilinx is a leading manufacturer of FPGA, the competition with Intel is also very fierce. This acquisition may change the market structure.

Skyworks acquired part of Silicon Labs' business for US$2.75 billion

Silicon Labs specializes in developing world-class mixed-signal devices and providing wireless chips for smart home devices. In April 2021, Skyworks acquired Silicon Labs' infrastructure and automotive businesses for US$2.75 billion. Skyworks mainly produces semiconductor chips for radio frequency and mobile communication systems, and its service targets include 5G network communication function chips for Apple's iPhone and iPad.

Texas Instruments acquires Micron's 300mm wafer fab in Lehi, Utah, U.S.

In July 2021, Texas Instruments announced that it would acquire Micron’s 300mm wafer fab in Lehi, Utah, for US$900 million, and complete the agreement by the end of 2021. Texas Instruments is a leading company in analog chips, dedicated to designing, manufacturing, testing, and selling analog and embedded processing chips, with a wide range of applications. This transaction will strengthen Texas Instruments' competitive advantage in manufacturing and technology. Lehi wafer fab will start with 65nm and 45nm technologies to produce Texas Instruments' analog and embedded processing products, and will upgrade/surpass these technology nodes according to demand.

Renesas Electronics acquires Dialog

In August 2021, Renesas Electronics acquired Dialog for US$5.9 billion to further consolidate its position as an important embedded solution provider and also help accelerate its listing plan. Dialog is the world's leading provider of highly integrated and energy-efficient mixed-signal ICs, mainly serving many customers in the high-growth market segments of the Internet of Things, consumer electronics, and automotive and industrial end markets.

Renesas Electronics has a market share of 30% in the automotive MCU field. By combining Dialog's low-power mixed-signal products, low-power Wi-Fi and Bluetooth connection expertise, flash memory, battery and power management, and its configurable hybrid With extensive experience and knowledge of signal (CMIC) solutions, Renesas Electronics will continue to expand its product portfolio and expand its market share.

Analog Devices Inc. acquired Maxim

In August 2021, Analog Devices Inc. announced the completion of the acquisition of MAXIM. ADI is the second largest manufacturer of analog chips. Its digital-to-analog converters, optical fiber and optical communication chips, MEMS and sensors have already covered industries, communications, automotive electrification, and consumer electronics. Maxim, ranked seventh, has a comprehensive high-performance semiconductor product line, as well as industry-leading design tools and support. It is committed to providing basic simulation solutions to help engineers solve various difficult problems (rapid development of smaller, smarter and safer the design of). ADI's acquisition of Maxim not only diversifies its product portfolio, but also helps it expand its market scale.